Once the buyer receives the proforma invoice, they can negotiate the terms of sale, such as an early payment discount.

#Proforma bill meaning plus

However, the buyer is dissatisfied because they wanted an earlier delivery date and longer payment terms, plus they could have negotiated a lower price.Īt this point, ABC Clothing could still salvage the sale by rushing to meet the delivery deadline, voiding the original invoice, and creating a new one with prices and payment terms the buyer agrees to. Once they complete production, ABC Clothing sends an official invoice to the buyer. After receiving the order, ABC Clothing immediately begins production without discussing it with the buyer. Let’s say a clothing manufacturer called ABC Clothing receives an order for 5,000 shirts. Here’s how a proforma invoice would be used in a manufacturing use case: Proforma Invoice ExamplesĪ proforma invoice is not an official confirmation of a sale, which means the buyer and seller can still negotiate the terms.

That’s why the terms in a proforma invoice are still subject to change, while a purchase order is a legally binding agreement. When it comes to a purchase order, it’s the buyer (and their accounts payable department) who issues and sends it to the seller and uses the document for invoice matching when disbursing payment.Ī purchase order is considered a commercial document, meaning an official confirmation of a sale, while a proforma invoice is a quote from a sale, not a confirmation. However, the difference between a proforma invoice and a PO is their origin: The seller prepares and sends a proforma invoice to the buyer. Purchase OrderĪt face value, a proforma invoice sounds the same as a purchase order. A commercial invoice also provides crucial instructions to the freight forwarder, import broker, marine insurance company, and the buyer’s and seller’s banks. In comparison, a commercial invoice is used by customs to assess the duties, taxes, and other import fees associated with the sale. This helps them to more efficiently prepare to receive the shipment. For example, buyers can use a proforma invoice to demonstrate to the government why they need an import permit. However, the main differences are in how they are used.īuyers use a proforma invoice to overcome import restrictions that could affect the sale. Proforma invoices and commercial invoices are both export documents commonly found in international trade.

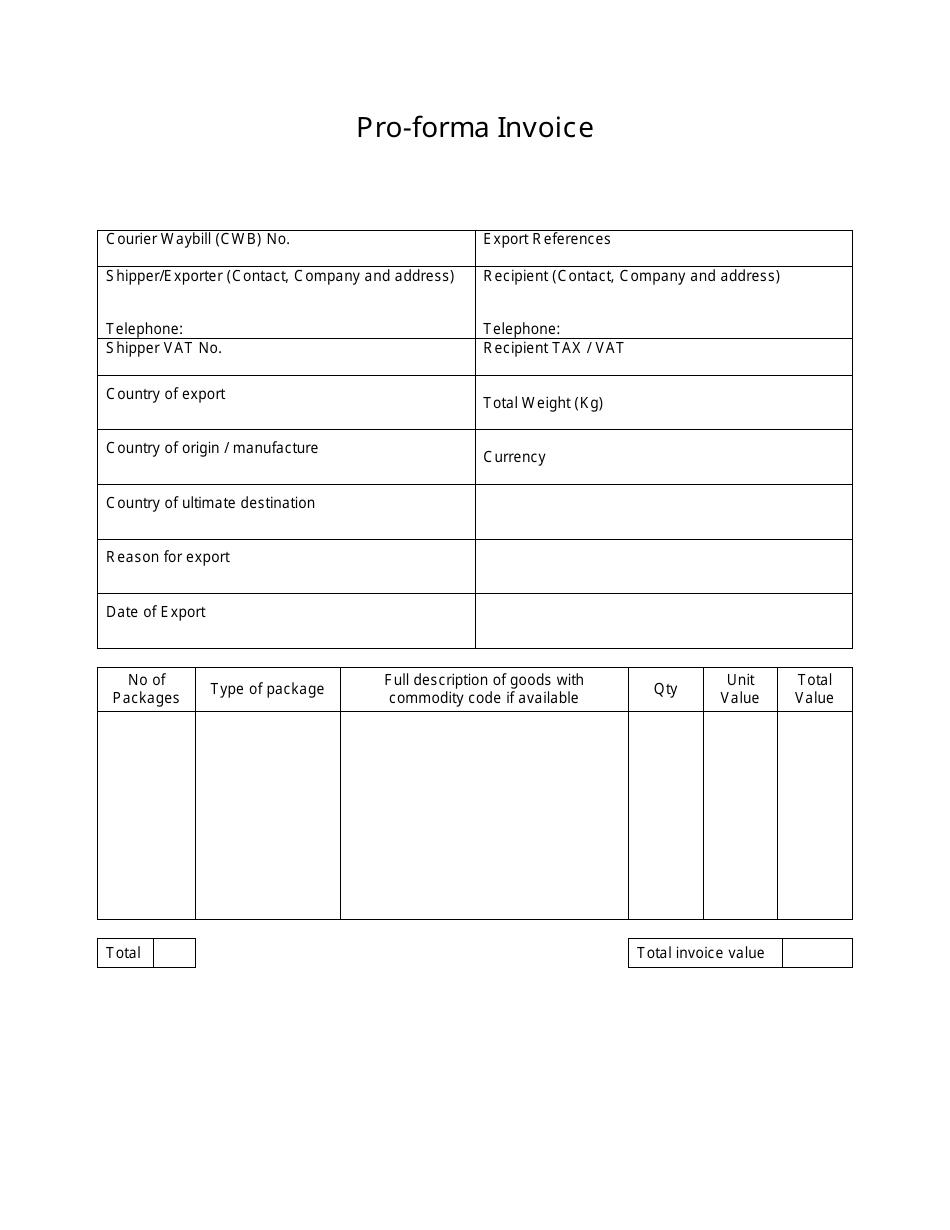

In the accounts payable process, a proforma invoice is used to create a sale, while an official invoice confirms the sale.Ī proforma invoice typically includes all of the information found in a standard invoice, but it should be clearly marked as “proforma.” To avoid duplicate payments, consider including a reference to the proforma invoice number on the standard invoice. In contrast, a standard or official invoice is recorded in your accounts payable or accounts receivable to be used for accounting purposes in case of an audit. While an invoice is official and legally binding, a proforma invoice simply sets expectations for both the buyer and seller. With this good faith estimate, a buyer can then decide whether or not to continue with the sale. The purpose of a proforma invoice is to provide the final details of an order to the buyer before they commit to a purchase. That means you shouldn’t record the total amount due under your accounts receivable or use the proforma invoice to reclaim value-added tax (VAT). In that sense, a proforma invoice is more like a sales quote than a final sales invoice. However, a proforma invoice is not legally binding because the terms of sale are still subject to change.

Global Partner Payments Scalable mass payout solutions for the gig, ad tech, sharing, and marketplace economies.Procurement Complete control and visibility over corporate spend.Accounts Payable Automation End-to-end, global payables solution designed for growing companies.

0 kommentar(er)

0 kommentar(er)